Cloud infrastructure market notches first $100B quarter driven by AI

Amazon, Microsoft, and Google all reported earnings last week, and the cloud was a bright spot with all three companies reporting solid growth, driven by growing AI resource requirements.

We saw Amazon top 20% revenue growth for the first time since Q42022, while Microsoft held steady at 39% and Google continued to gain ground with 34%, up two points over last quarter, per Jamin Ball at Clouded Judgement.

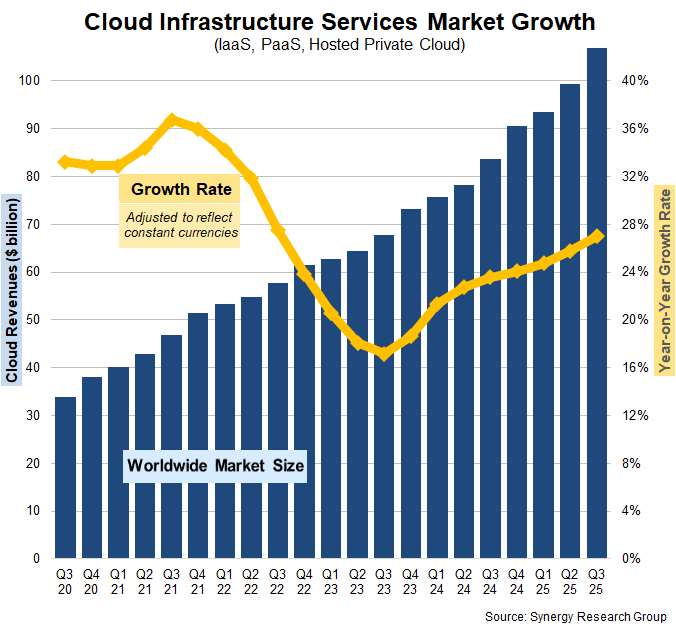

Synergy Research reports that cloud revenue crossed the $100 billion quarterly threshold for the first time, leaping $7.5 billion to $106.9 billion. Synergy says that’s the largest quarter-over-quarter increase ever.

In terms of market share, Amazon led the way with 29%, followed by Microsoft and Google with 20% and 13% respectively. Rough math puts quarterly revenue at around $31 billion for Amazon, $21 billion for Microsoft, and $14 billion for Google. That’s a monster quarter, any way you slice it.

Good news, bad news

What’s driving this? Why AI of course. We keep seeing headline after headline of these companies making big AI deals, each worth billions of dollars, whether it’s with the big three or the newer neocloud vendors. Everyone it seems is getting in on the action, and for now, it’s good times ahead for the cloud vendors.

As demand heats up, so do the demands on the vendors, and the biggest cloud vendors on the planet seem to be having trouble keeping up. And that’s in spite of unprecedented CapEx spend from each one as Microsoft reported $35 billion, Amazon $34 billion, and Google $24 billion in quarterly CapEx. Satya Nadella suggested during his earnings call with analysts that Microsoft’s cloud growth numbers would have been even bigger had it not been for the resource constraints the company is experiencing.

It would seem that having too much demand is a good thing, except when the demand is so great it exceeds capacity in spite of these big numbers. It’s mind-boggling but true — they can’t build fast enough.

Some surprises

But in spite of the solid quarter, there were still some surprises including Amazon dropping below 30% for the first time I can remember, and I’ve been tracking these numbers since 2018. John Dinsdale, a chief analyst at Synergy, says Amazon had actually dropped below 30% a couple of quarters ago, but because of the way they round off percentages, it didn’t show up until now.

“In truth, not a big shift from the previous quarter. Significant? Somewhat,” Dinsdale told FastForward. “Its market share over the last four quarters combined was 30%, and for the preceding four quarters was 31%. So its market share has nudged down as Microsoft and Google grow more rapidly.”

Perhaps a bigger surprise was how little market share that Oracle still has with just 3% share. We have been hearing about these huge deals that Oracle has been signing, but possible revenue in the future doesn’t add up to revenue in the present, Dinsdale says.

“Oracle are the masters of making a big noise. They have signed some huge deals but these are bookings and future commitments or plans, not current revenues. Any company can shout about the future, but it is current revenue where the rubber meets the road,” he said.

Cloud infrastructure spend keeps climbing, with the market now on a run rate above $400 billion. The numbers have never been bigger, and with lots of business on the books for the future, it could go even higher. Although a slowdown in AI demand or lagging data center buildout could change the picture, for now the momentum is real.

Featured image by Mohamed Nohassi for Unsplash+.